A $22 Trillion Stock Rally Now Hinges on Rapid Economic Recovery

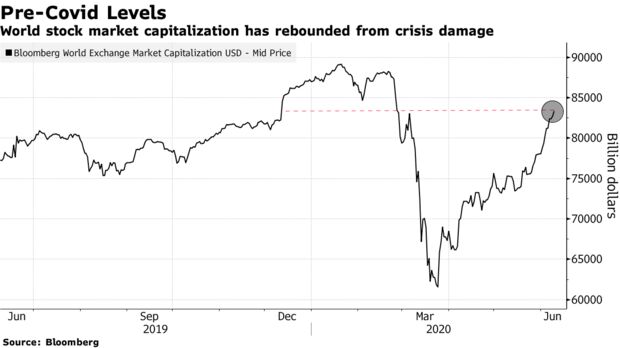

The rebound in global stocks back to December levels -- before the world had heard of Covid-19 -- has outstripped the monetary stimulus pumped into economies by global policy makers, raising the stakes for the V-shaped rebound that has been priced in.

The global stock market’s capitalization has climbed by roughly $22 trillion from the March low. Tallies of central bank stimulus are fraught with challenge, but Morgan Stanley last month predicted $13 trillion in cumulative balance-sheet expansion during the current easing cycle from the U.S., euro region, Japan and U.K. through the end of 2021.

The 40% plus rally in the MSCI All Country World Index from its March low suggests it’s not just policy measures that have rescued investors, but expectations of a real-economy rebound. UBS Group AG analysts say that high-frequency indicators of mobility -- such as foot traffic at retailers and metros -- support the equity surge.

The danger, though, for investors and policy makers alike is that any complication in the economic recovery could see market gains swiftly reverse -- at a time when there’s less room for additional policy support, given the scope of what’s already been deployed. And while markets will likely look through horrific second-quarter data, tolerance for depression-like numbers into the second half may be thin.

“It is prudent to expect the script on the pandemic to have a few more dark turns,” said Mark Zandi, chief economist at Moody’s Analytics. “If stock prices slump significantly again, this would be another headwind to the global economic recovery, and put even more pressure on central banks and governments.”

Familiar Movie

Of course, rallying markets are to be celebrated if the global economic outlook lives up to the optimism. And markets are supposed to price in the future -- not the past -- as evidenced with the U.S. credit-market’s unfreezing even before the Federal Reserve got its corporate-debt purchases going.

“The disconnect is a movie I have seen many times,” said Allen Sinai, a Wall Street veteran who has worked as an economist for more than four decades and heads Decision Economics, Inc. “I have seen it in every recession, every downturn. The stock market, before the end of recession, begins to go up and the next equity bull market begins.”

On Monday, the S&P 500 Index turned positive for the year on the very same day that the National Bureau of Economic Research announced that the U.S. economy had officially entered recession for the first time in over a decade. As of Wednesday, it was down just 1.3% for 2020.

Synchronized Downturn

More than 90% of economies are set to experience a recession this year

Source: World Bank

History also features rallies that faltered, complicating the road to recovery. The S&P 500 by early January 2009 had enjoyed a 24% climb from a November 2008 low, but the financial crisis had another sting in the tail to come. The index tumbled 28% by early March 2009, keeping pressure on for stimulus. For his part, Fed Chair Jerome Powell Wednesday emphasized that the central bank will be keeping its easy policy for potentially years to come.

With the lockdowns and subsequent re-openings disrupting economic patterns like never before, traders have turned to using high-frequency indicators such as location-tracking data from smartphones published by Apple Inc., Alphabet Inc.’s Google and Baidu Inc, as well as restaurant reservations from OpenTable Inc and traffic statistics from TomTom NV.

They all offer a gauge of whether life is returning to normal -- on the assumption that economic activity should improve as well.

“How good the information they carry will be known when we know if hard, traditional data is following the pointers we are getting,” said Binay Chandgothia, portfolio manager at Principal Global Investors. “For now, they are the only real information sources and they seem like logical data points.”

Betting on V

Optimists point to the shock 2.5 million increase in U.S. payrolls and decline in the unemployment rate to 13.3% as firmer evidence of a rebound.

Goldman Sachs Inc. economists led by Jan Hatzius argue that if global GDP is now rising, the recession will be the deepest -- but also the shortest -- since World War II. Morgan Stanley Chief Economist Chetan Ahya holds a similar view, arguing that upside surprises in economic data points to a “deep V-shaped recovery.”

Stocks have moved to price that in. With corporate earnings having collapsed thanks to the lockdowns, the price-to-earnings ratio of the S&P 500 currently sits at 25.6 times, the highest since the dotcom bubble, and far above the average of just under 17 since the start of 2000.

Investment-grade corporate bonds have also come back, with yields hitting record lows, pulled down by the powerful rally in government debt. While 10-year U.S. Treasury yields have climbed from their March lows, analysts surveyed by Bloomberg see them staying below 2% for years to come, effectively held down by the Fed and continued disinflation.

“The big hope is that this optimism, which reflects the silver lining of this historic shock, proves right,” said Mohamed El-Erian, chief economic adviser at Allianz SE and a Bloomberg Opinion columnist. “But every element requires politicians to remain highly focused, put political polarization aside and appropriately evolve their policy approaches.”